Why MRF Share Price is High | 3 Reasons Why MRF Share Price is so Expensive

MRF is a well-known Indian tire manufacturer (to know more about Why MRF Share Price is High) with a reputation for producing high-quality tires for various applications. The company has a strong market position in the Indian tire market and has been able to maintain high profitability over the years.

3 Reasons Why MRF Share Price is so Expensive

There could be several reasons why MRF’s share price is high and expensive in 2023.

- Strong brand reputation: Firstly, the company has a strong brand reputation and is considered a premium tire manufacturer in India. This premium brand image could be a factor in the company’s high share price.

- Indian tire market is expected: Secondly, the Indian tire market is expected to grow at a steady rate over the coming years, driven by increasing demand for automobiles and government initiatives to boost the domestic manufacturing sector. This growth could be a factor in MRF’s high share price.

- Maintain a strong financial performance: Thirdly, the company has been able to maintain a strong financial performance over the years, with a high level of profitability and a strong balance sheet. This financial stability could be another factor in the company’s high share price.

However, it’s important to note that stock prices can be volatile and are subject to market and economic conditions. It’s always a good idea to perform thorough research.

Which is the Costliest Share in India?

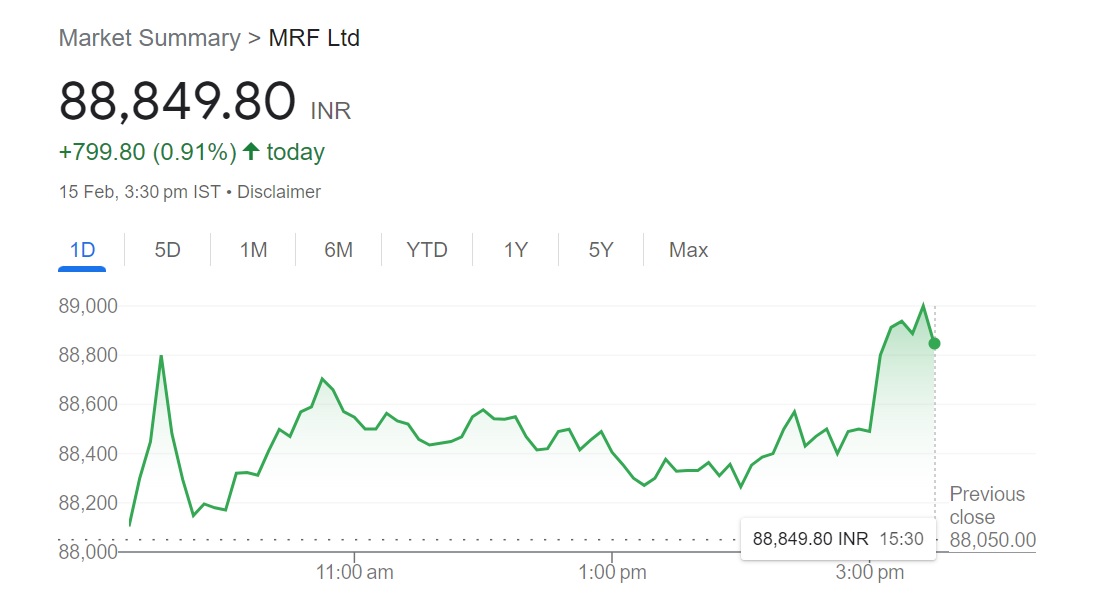

MRF is the costliest share in India. Currently it is trading over 88,849.80 INR.

FAQ: MRF Share

What will be the share price of MRF in future?

guess: 5-year investment, the revenue is expected to be around +32.31%

Is MRF a good stock to buy for long term ? | Why MRF share price is so high?

The reason lies in its high growth rate over a long period, accompanied by consistently net solid profit margins and return on equity ratios.

Is MRF a good stock to buy?

MRF is also a massive brand in India, and people trust this brand. It’s always a good idea to perform thorough research and analysis, consult with a financial advisor, and consider your personal financial goals, risk tolerance, and investment horizon before making any investment decisions.

Full Detail of MRF Share:

Madras Rubber Factory, commonly known as MRF or MRF Tyres, is an Indian Multinational tyre manufacturing company and the largest manufacturer of tyres in India. It is headquartered in Chennai, Tamil Nadu, India.

MRF Company Detail:

Financials of MRF Share:

| (INR) | Sept 2022 | Y/Y |

|---|---|---|

| Revenue | 5.83TCr | |

| Net income | 129.86Cr | |

| Diluted EPS | 306.19 | |

| Net profit margin | 2.23% |

Conclusion

In above post we discussed about Why MRF share price is so high? We hope that you liked this article. We recommend you to visit out other pages about Indian stock market to enhance your knowledge about investing.

People Also Search: